Looking for the most disc golf courses in 2025 should be simple. Count baskets, rank countries, job done.

Yet anyone who actually plays knows the feeling. You scroll a map showing plenty of green dots, turn up full of optimism, and still end up waiting on a tee pad behind three groups who all had the same idea.

This article updates the numbers using the latest PDGA course and player data, reviewed in early 2026. Some patterns remain familiar. Others make a lot more sense once you stop treating disc golf like a numbers game and start treating it like a habit.

Because access, pressure, and participation are not the same thing.

Key questions about disc golf course rankings and access

Where are the most disc golf courses in 2025

The United States still leads by a long way. Finland remains second. That headline has barely changed.

What has changed is how useful it is on its own.

A country can have thousands of courses and still feel awkward to play if they are spaced far apart or heavily relied on. Another can have far fewer courses and feel effortless because they sit neatly inside daily routines.

How many disc golf courses exist worldwide

The PDGA course database now lists just over 16,000 permanent disc golf courses worldwide. That is a noticeable step up from older estimates and reflects steady growth across Europe, North America, and parts of Asia.

This figure counts installed courses only. Temporary layouts and pop-up events do not appear here, which matters if you play in regions that lean on seasonal setups.

Which countries need more courses now

High player-to-course ratios flag where demand has arrived before infrastructure.

Norway, Sweden, Taiwan, and China still stand out. But more baskets only help if people have reasons to keep returning. Infrastructure opens the door. Culture decides whether anyone walks back through it.

What the player-to-course ratio actually shows

This ratio divides registered PDGA players by the number of courses. It does not measure how busy a course feels on a sunny weekend.

It shows how much organised play is leaning on the infrastructure. Think leagues, competitions, and the players who turn up even when the weather looks unconvincing.

Which US states feel easiest to play

States with fewer players per course often feel calmer. Vermont continues to punch above its weight here. Large states like California and Texas dominate on volume, but ease of access varies wildly once you zoom in.

Travel time matters more than totals.

Top states and countries with the most disc golf courses

The table below pairs course counts with organised-player pressure. It reflects how the system behaves for people who play regularly, not just those who tried a round once.

| Country | PDGA Courses | Players per Course | What This Suggests |

|---|---|---|---|

| United States | ~7,900 | ~5–6 | Huge scale, uneven local access |

| Finland | ~750 | ~10 | Dense, heavily used courses |

| Sweden | ~280 | 30+ | Demand rising faster than supply |

| Norway | ~155 | ~40 | Strong interest, tight access |

| China | <10 | 30+ | Early growth, limited options |

Finland keeps appearing because its courses are not treated like destinations. They are treated like routines. The United States wins on volume, but that volume hides enormous local variation.

Which countries have the most disc golf courses in 2025

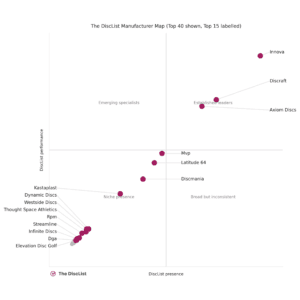

Rankings tell you where baskets exist. Ratios hint at how often they get used.

United States

Thousands of courses spread across a huge land area. Access depends far more on state and region than on national totals.

Finland

Fewer courses, closer together, used often. Playing fits neatly into weekly life rather than requiring a special trip.

Sweden and Norway

Strong interest and rising pressure. In many areas, one additional course can change how the whole scene feels.

China and Taiwan

Small totals, high ratios. Growth from a low base, with demand already pressing against limited supply.

United States states with the most disc golf courses

National averages flatten the picture. State-level data shows why access feels so different from place to place.

| State | Courses | Players per Course | Access Feel |

|---|---|---|---|

| California | ~1,200 | ~6–7 | Plenty of courses, long drives |

| Texas | ~1,100 | ~6–7 | Big scale, uneven coverage |

| Illinois | ~500 | ~6 | Balanced and playable |

| Vermont | ~100 | ~3 | Short travel, low pressure |

Vermont appears again for a simple reason. When courses are close, playing becomes a default option rather than a planned outing.

Underserved regions where disc golf needs more courses

High ratios show where interest is doing more work than infrastructure.

| Region | Players per Course | Courses | Why It Matters |

|---|---|---|---|

| Norway | ~40 | ~155 | Regular queues and league pressure |

| Sweden | 30+ | ~280 | Participation outpacing builds |

| Taiwan | ~30 | <5 | Small base, heavy use |

| China | ~35 | <10 | Early demand, few options |

In these regions, one well-placed course can shorten travel, reduce queues, and turn occasional play into habit. But only if there is something pulling players back next week.

Where disc golf is growing fastest

Growth behaves differently depending on context.

China and Taiwan are expanding quickly from a small base. Finland and the United States keep adding courses at a steady pace. Across northern Europe, the emphasis has shifted from adding more baskets to placing them better.

A familiar pattern repeats. Courses appear first. Organised play follows years later, if it follows at all.

How this data fits together

The PDGA player database lists just under 295,000 people who have ever held a number. Only around 30 percent are current members.

That gap is the story.

PDGA data reflects commitment, not total participation. App-based platforms show far higher casual play. The missing middle is where most people drift away. They enjoy disc golf. Then distance, time, or habit gets a vote.

Courses make disc golf possible. Habits keep it present.

When comparing disc golf courses by country or by state, PDGA course data paired with participation context gives the clearest picture. One without the other is an attractive mistake.

Conclusion the future of disc golf access

The headlines still behave themselves. The United States has the most disc golf courses. Finland remains a benchmark for access. Several regions are clearly short on infrastructure.

What has changed is how those facts should be read.

Building courses shortens drives. Building reasons to return keeps players. The healthiest disc golf systems do both, quietly and without fuss.

That is why some places feel easy to play, even with fewer baskets. And why others feel busy despite having plenty.

Disc Golf Course Numbers and Access Explained

There are just over 16,000 permanent disc golf courses worldwide listed in the PDGA course database. This figure excludes temporary layouts and pop-up courses, which means actual play options can be higher in some areas.

The United States has the most disc golf courses by a wide margin, with thousands spread across all states. However, access varies greatly depending on location and travel distance.

Finland has many courses placed close together and used regularly. This makes disc golf easy to fit into weekly routines rather than something that needs planning.

No. A low player-to-course ratio shows lighter organised play, not low casual use. Courses can still be busy outside competitions and league nights.

No. PDGA numbers reflect organised participation only. Many disc golfers play casually and never register, so total participation is much higher.

Courses can feel busy when player interest grows faster than new courses are built. Active leagues and repeat play increase pressure on the same layouts.

No. Real access depends on travel time, course placement, and how often people play, not just the total number of courses.