The DiscList Annual Report 2025 is now live, and it tells a story that is quieter, steadier, and more revealing than most people expect.

Rather than chasing weekly spikes or headline launches, the report looks at how disc golf attention actually behaved across the season. Week by week. Month by month. From late March through to December.

The result is not a list of surprises. It is a map of gravity.

What Is The DiscList Annual Report 2025

The DiscList tracks which discs and manufacturers appear most frequently and most strongly across weekly snapshots of global retail activity.

Two ideas matter throughout the report.

- Presence, how often a disc or manufacturer shows up across the season

- Performance, how strongly it performs when it does appear

The annual report steps back from individual weeks and looks at patterns over time. It is not trying to predict what will happen next. It documents what stayed in orbit.

What The 2025 Data Shows At A Glance

If you only take one thing from the DiscList Annual Report 2025, it should be this.

- Attention concentrated around a small core of discs

- Once discs reached the upper tier, they tended to stay there

- Breakouts existed, but most gains were gradual rather than explosive

- Manufacturers that combined focus with execution outperformed those relying on range alone

In other words, consistency beat novelty almost every time.

Why Stability Matters More Than Hype

One of the clearest findings in the report is how stable the Top 40 became as the year progressed.

Discs that entered the upper ranks were far more likely to reappear than to disappear. Short-lived spikes happened, but they were the exception rather than the rule.

For players, this helps explain why certain moulds feel ever-present. For retailers, it quietly challenges the assumption that a wider range always means a better offer.

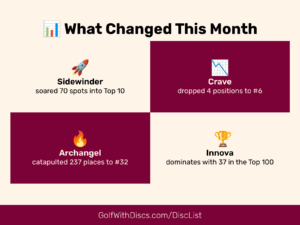

Movement Still Happened, Just Not How People Expect

Stability does not mean stagnation.

The report highlights climbers and breakouts that earned their position over time. What stands out is how few of these moves were sudden. Most discs climbed because they kept showing up, week after week, rather than arriving with a bang.

Momentum, when it appeared, was usually something that had been building for months.

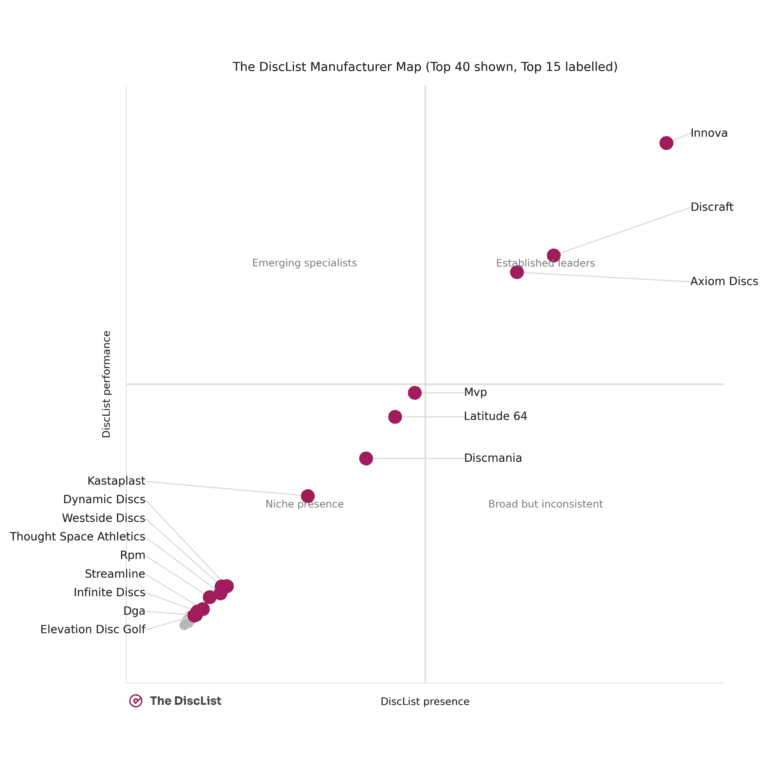

The DiscList Manufacturer Map

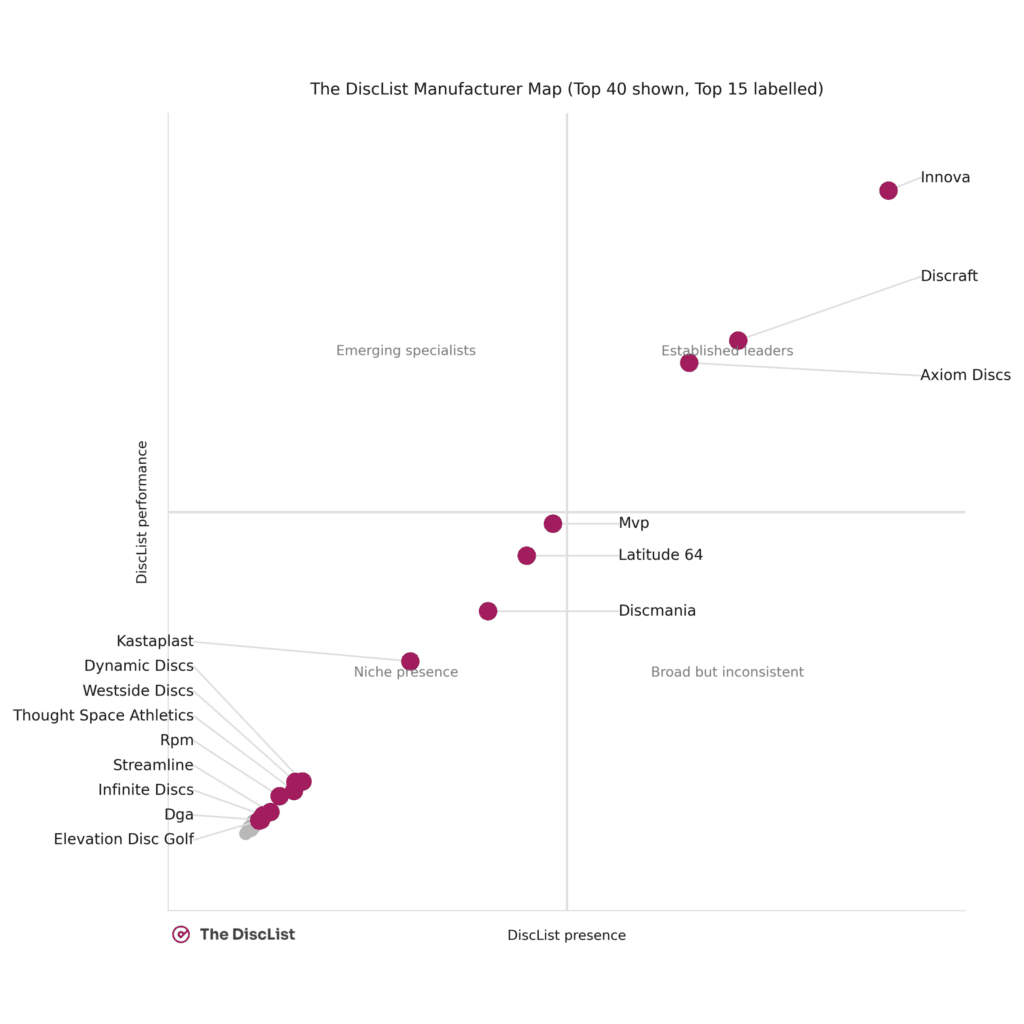

One of the most shared parts of the DiscList Annual Report 2025 is the Manufacturer Map.

It compares manufacturer presence against manufacturer performance to show how different brands balanced breadth and consistency across the season.

This is not a prediction chart. It does not tell anyone what they should do next. It simply shows where attention concentrated in 2025.

That distinction matters.

Why This Matters If You Sell Or Buy Discs

There is constant pressure in disc golf retail to carry more moulds, more plastics, more colours, and more weights.

The DiscList data suggests that pressure is often misplaced.

Across the 2025 season, demand repeatedly returned to a relatively small group of proven discs. Shops rarely fail because they stock too little. They fail because they stock too much.

For players, this explains a familiar frustration. You might not always find the exact colour or weight you want, but sticking close to the discs that stay in orbit dramatically improves the odds.

Where To Read The Full DiscList Annual Report

The GolfWithDiscs summary only scratches the surface.

The full DiscList Annual Report 2025 includes detailed charts, manufacturer awards, and a complete explanation of the methodology.

You can read the full report and download the PDF here.

Read the DiscList Annual Report 2025

If you share the report or reference the data, attribution to TheDiscList.com is appreciated.